DIME Analysis: Protect What Matters Most

- Debt

- Income Replacement

- Mortgage

- Education

- Debt

- Income Replacement

- Mortgage

- Education

One Powerful Tool. Four Core Needs.

The DIME Analysis is a simple yet powerful tool designed to help individuals and families determine exactly how much life insurance they need to protect their loved ones. Instead of guessing, DIME walks you through four essential areas:

- D - Debt: Credit cards, personal loans, auto loans, etc.

- I - Income Replacement: Covering years of income your family would need to maintain their lifestyle after you are gone.

- M - Mortgage: Ensuring your home is paid off or covered.

- E - Education: Covering for your children's college or higher education costs.

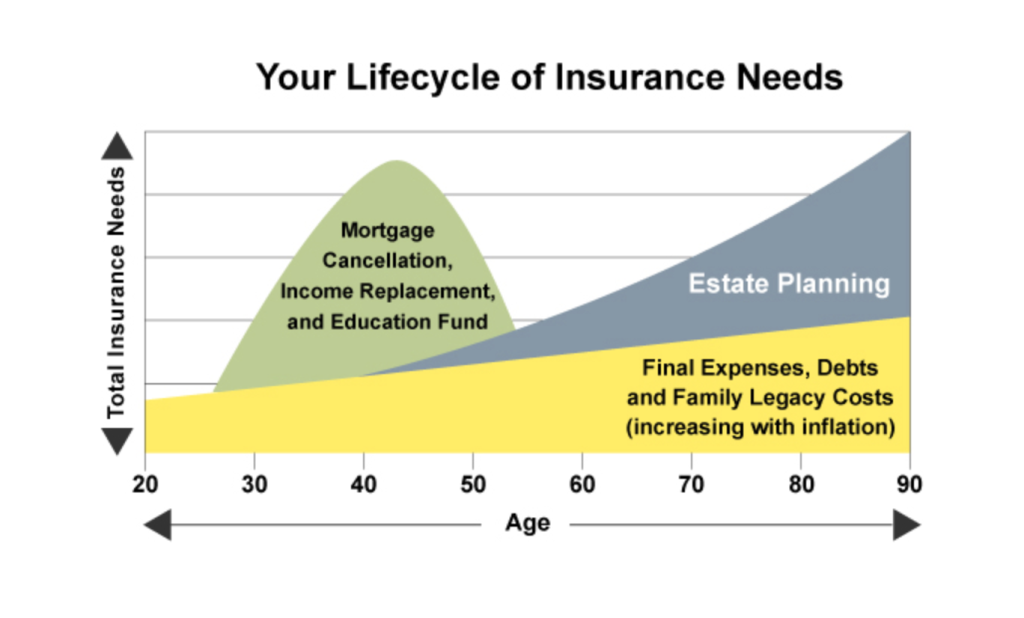

Why It Matters Now

Life insurance isn’t just about replacing income—it’s about protecting dreams. Whether you’re a parent, homeowner, or key income earner, a personalized DIME analysis ensures your family is protected from financial instability.

- No more guesswork

- Tailored to your exact situation

- Built with your family's future in mind

What You Receive

- A free, no-obligation consultation

- Personalized coverage recommendations

- Clarity on your current exposure

- A legacy plan designed for your peace of mind

Who Should Consider DIME?

- Parents with young children

- Homeowners with an active mortgage

- Primary breadwinners

- Dual-income households

- Anyone unsure about how much coverage they really need

Let’s Get Started

Book your complimentary DIME session today. This 15-minute analysis could protect your family for a lifetime.

Because life doesn’t come with warnings. Just consequences.Plan smart. Protect well.

Please share your name, email, and phone number to schedule a complimentary, no-obligation 30-minute session to discover your personalized DIME number (Debt, Income, Mortgage, Education needs).

Click here to Book your Call

**Only 5 spots left for this month**

Looking forward to helping you plan with clarity!